Voluntary Carbon Market Developer Overview 2024-2025

🤩 We’ve just published our first industry report: The Voluntary Carbon Market Developer Overview 2024–2025.

This one is for the people in the trenches of climate action—carbon project developers. They’re the ones planting trees, installing biogas digesters, and swapping out smoky three-stone fires for clean cookstoves. It’s not easy work, and it often happens far away from the LinkedIn spotlight, but it’s what keeps this whole market moving.

Here’s a taste of what’s inside:

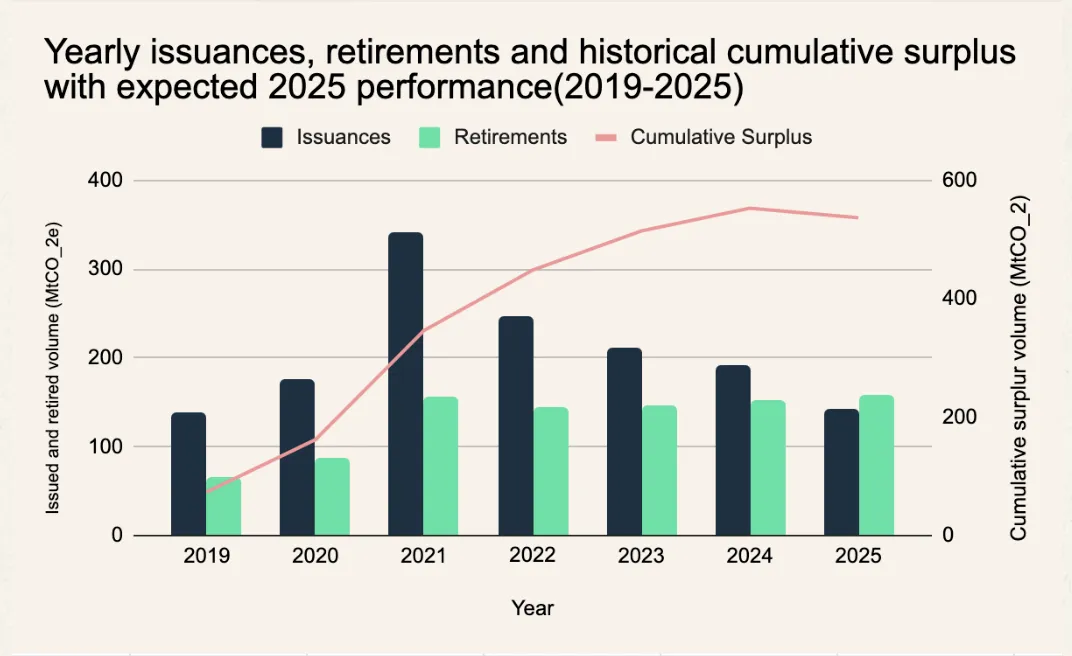

Market balance is shifting: Credit issuances dropped 10% from 2023 to 2024, while retirements kept growing.

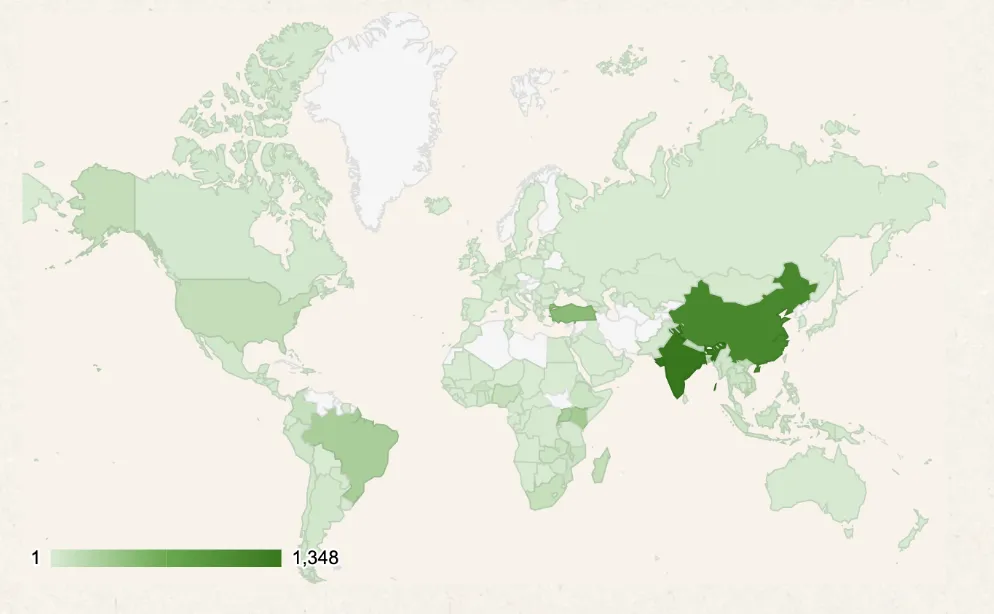

Where projects are happening: India still leads with over 1,300 projects, but East Africa is coming on strong. Kenya, Uganda, Rwanda, and Malawi are quickly becoming a hub.

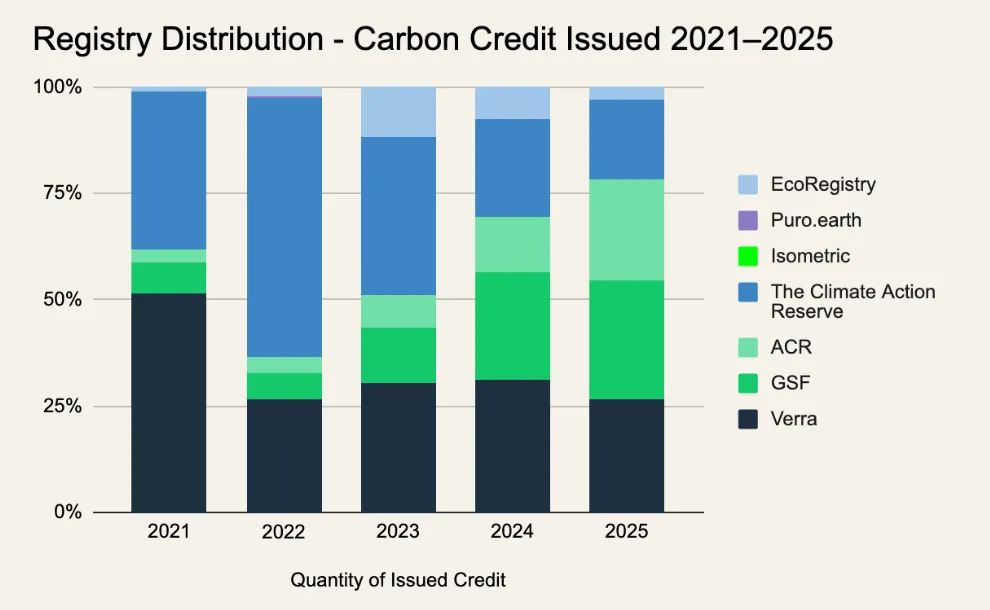

Registries on the move: Verra’s output has fallen sharply since its 2021 peak. Gold Standard is gaining steadily, with newer registries like Isometric and Puro.earth quietly making progress.

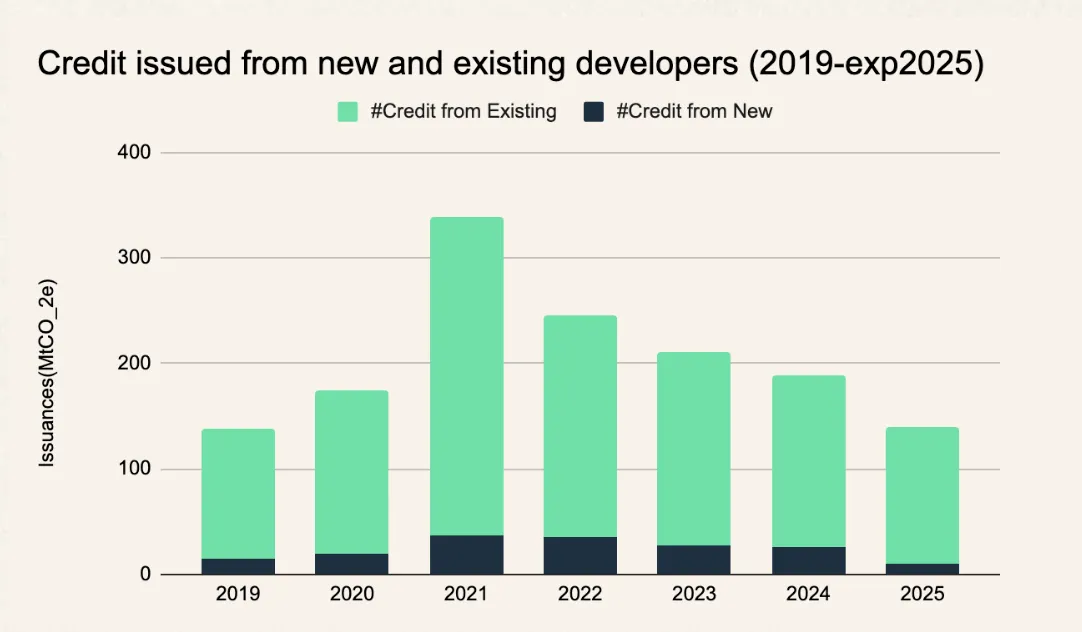

More players entering: Over 100 new developers issued credits in 2024. The top 10 developers now account for just 23% of supply—a sign of a more diverse, less concentrated market.

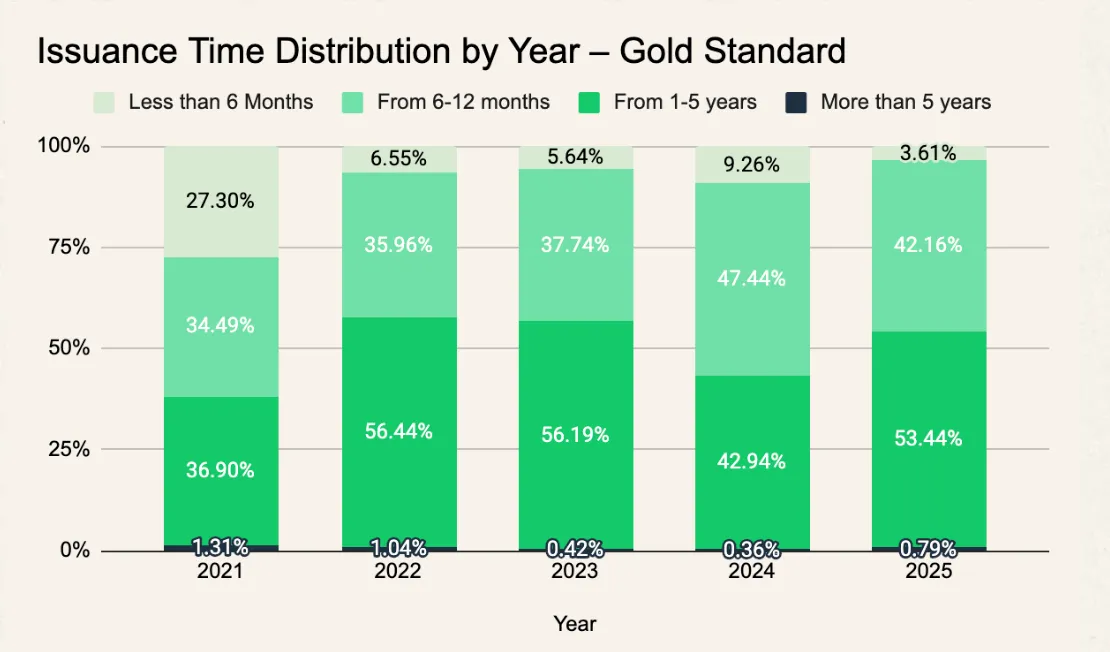

Faster issuances: Gold Standard has cut its timelines significantly, with nearly half of its 2025 issuances completed within a year. That speed matters for developers who need quicker monetisation.

We’ve also included rankings of developers across project types - energy, household devices, nature-based solutions, and waste, so you can see who’s shaping supply right now.

👉 Download the full report here

We put this together with a lot of care (and coffee), but we’re a small team, so apologies in advance for any rough edges. If you find it useful, please share it around. And if you have feedback, I’d love to hear it, just drop me a note at [email protected].

Special thanks to our intern, Susie Zhang, for leading the work on this report!

- Allen & the CarbonHQ team